Benefits of Being a Filer in Pakistan

Benefits of being a Filer in Pakistan: All responsible persons are required to file taxes. Being responsible can profitable in the long term because there are numerous advantages to filing taxes. Pakistan’s GDP in 2020 was 262.61 billion.

The Concept of Filer and Non-Filer Taxpayer in Pakistan

The person who wants to become a filer must be on the Active Taxpayer List, according to Section 2 (23A) of the Income Tax Ordinance 2001. It is evident that if a person appears on the ATL list, he is designated a ‘Filer’.

In contrast, if a person does not show on the ATL list, he is considered a ‘Non-filer.’ Every month on the 15th, the List of Active Payers is updated. Furthermore, the Taxpayer List is updated weekly if taxpayers are having issues.

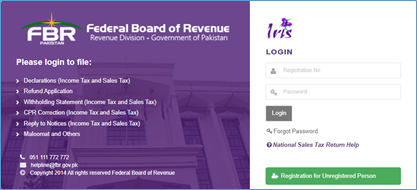

Steps of how to become a Filer in Pakistan

The FBR has an online registration method for tax filers. If you already have a National Tax Number or NTN, go to the official FBR website and click on the ‘submit income tax returns’ option. Then click on logging into Iris by this link. Login-Tax Payer (fbr.gov.pk)

After entering all of your information, your phone number and email address will be validated using different codes delivered to your phone and email when you click ‘submit’.

After your phone number and email address have been validated, you will receive a text message with your registration number, which is comparable to your CNIC number, as well as a password and pin code.

You can now access your Iris account by entering your registration/CNIC number and password. Save the pin code since you will need it again when filing your income tax returns and submitting your wealth statement.

Those with a National Tax Number (NTN) or Registration Number but no credentials to connect to Iris can access it by clicking on ‘E-enrollment for Registered Person.’

For those salaried, you will need to present a bank statement and the amount of taxes deducted. All information about your income in the preceding year and the money you earn from your property, if you possess one, will be added.

Be a Filer and Save on Property Buying

On property transfers, active taxpayers pay only 1% tax. In comparison, non-filers pay 2% tax, and tax filers pay 2% tax on the total amount of purchased property, while non-filers pay 4% tax on the same property.

A non-filer cannot acquire any property worth more than Rs 5 million. However, active taxpayers are not prohibited from doing so. The filer pays a 10% tax on government auctions, but non-filers pay a 15% tax on government and other company auctions.

- Filers will save taxes while purchasing, selling, or transferring property.

- Filers make up 1% of the population, whereas non-filers make up 2%.

- On the purchase of a property worth more than Rs. 40,00,000, the value tax ratio is 2% for filers and 4% for non-filers.

There are numerous advantages to becoming a filer, including reduced tax deductions and reduced tax on property purchases and sales. Therefore, why not be a filer today? For additional information about becoming a filer, please visit the FBR website.

Leave a comment: